Sugar tax: The fight against sugar is just beginning

“We’ve started small with an 11 percent tax and there was strong pushback. We accept that but now we’ve got a foot in the door, we’re not going to stop there,” Motsoaledi told Health-e News earlier this month. “We are going to increase it, there is no question about it. At least I will not stop there; I am going to push later on.”

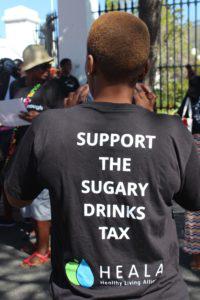

In December, after 18 months of negotiations that included four parliamentary hearings and extensive debates in Nedlac, parliament passed an 11 percent tax on sugary beverages, termed the health promotion levy, due to be implemented on April 1.

Along with bringing much-need revenue to the fiscus, the tax is intended to incentivise the public to consume less sugar in the form of liquid calories, a major contributor of soaring rates of diabetes, obesity and other health conditions like hypertension and certain cancers.

The Department of Health is concerned about its ability to finance the health impacts of South Africa’s growing obesity epidemic. According to the latest South African Demographic and Health Survey, more than two thirds of local women are either overweight or obese, placing them at a high risk of developing a myriad of chronic diseases.

Effect of higher tax

But the level of the tax disappointed a number of academics and activists who were advocating for a 20 percent tax, which research has found would have a much more significant impact on lowering consumption and improving people’s health.

A modelling study published in the medical journal BMJ Global Health in January, conducted by the research body based at Wits University Priority Cost Effective Lessons for Systems Strengthening South Africa (PRICELESS), predicted the potential health impact of a stronger tax.

Using an indicator of “years of life gained due to avoided premature mortality”, said PRICELESS’ Nick Stacey, the current tax is predicted to result in a gain of over 300 000 life years over a 30 year period. But a 20 percent tax could double this: resulting in 688 719 life years gained, according to the study.

Although the “tax is a necessary first step” in reducing sugar consumption and improving health, “the tax on its own” will not necessarily have the impact needed to address South Africa’s obesity crisis, according to the Rural Health Advocacy Project’s Russell van Rensburg.

“We need to also work towards ring-fencing the money gained from the tax for broader health education and health promotion programmes which will be essential for changing people’s consumption behaviour,” he said.

Health promotion campaigns

While Treasury has a policy of not ring-fencing taxes, they have made some financial provision for health promotion campaigns to compliment the introduction of the tax.

In Treasury’s national budget, published in February, an amount of R368 million was allocated over the next three years “to begin a public awareness campaign to complement the health promotion levy on sugary beverages and to establish a health technology assessment unit”.

But this amount is only a fraction of the revenue Treasury anticipates collecting from the tax: R1.93 billion.

It is also unclear just how much of this will be used for public campaigns around sugar and how much will be set aside for the health technology assessment unit, a body that will “analyse the cost effectiveness of various health interventions”.

Popo Maja, head of communications at the National Department of Health, told Health-e News that he is unable to provide this budgetary breakdown at this stage and that the details will only be released during Motsoaledi’s budget speech on May 13.

But he said the campaign would use mass media adverts, including on television and radio, to talk “specifically about sugar and the role it plays in diseases like diabetes and also the impact it has on obesity”.

But increasing the tax will not be easy, conceded Motsoaledi, due to the heavy lobbying by big business experienced in negotiations for the current levy, which he expects will continue alongside any future efforts to push for a stronger tax or any other policies against sugary beverages.

Fight against industry

“We are interfering with commercial entities which are very powerful,” he said.

He compared the “fight” to legislate around sugar to that of tobacco.

Big business is able to fight against increasing taxes on tobacco even when, he said, “it is agreed that smoking is one of the most dangerous and useless past-times humanity has ever been involved in”.

“There is no evidence anywhere that cigarettes contributed anything to the development of humanity but there is ample evidence that they have actually retarded the development of human beings because of the number of health problems they have caused and the amount of resources used to deal with those,” he said. “But still the cigarette companies fight back, mobilise and find allies including workers.”

Referring to the claims made by industry that the tax would impact on jobs and the economy, Motsoaledi said that the “link between health and economic growth is not up for discussion”.

“You cannot dream of growing your economy without good health,” he said.

Despite the anticipated pushback from industry, Motsoaledi said banning fizzy drinks at government events is not “far off”.

“What wisdom does it show for sugary drinks to be available at parliamentary events when this sugar tax was passed by parliament?” he asked. “Even when you go to an event organised by the Department of Health you will find all these fizzy drinks – it’s embarrassing.”

He said “we are going to have to abolish them” in the same way alcohol was banned at government events.

“People have gotten used to no alcohol and will get used to no sugary drinks. So it’s not far off – at least, I am going to push for it because the alternative is too ghastly to contemplate.”

An edited version of this story was published by the Daily Maverick

Author

Republish this article

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Unless otherwise noted, you can republish our articles for free under a Creative Commons license. Here’s what you need to know:

You have to credit Health-e News. In the byline, we prefer “Author Name, Publication.” At the top of the text of your story, include a line that reads: “This story was originally published by Health-e News.” You must link the word “Health-e News” to the original URL of the story.

You must include all of the links from our story, including our newsletter sign up link.

If you use canonical metadata, please use the Health-e News URL. For more information about canonical metadata, click here.

You can’t edit our material, except to reflect relative changes in time, location and editorial style. (For example, “yesterday” can be changed to “last week”)

You have no rights to sell, license, syndicate, or otherwise represent yourself as the authorized owner of our material to any third parties. This means that you cannot actively publish or submit our work for syndication to third party platforms or apps like Apple News or Google News. Health-e News understands that publishers cannot fully control when certain third parties automatically summarise or crawl content from publishers’ own sites.

You can’t republish our material wholesale, or automatically; you need to select stories to be republished individually.

If you share republished stories on social media, we’d appreciate being tagged in your posts. You can find us on Twitter @HealthENews, Instagram @healthenews, and Facebook Health-e News Service.

You can grab HTML code for our stories easily. Click on the Creative Commons logo on our stories. You’ll find it with the other share buttons.

If you have any other questions, contact info@health-e.org.za.

Sugar tax: The fight against sugar is just beginning

by Amy Green, Health-e News

March 19, 2018

MOST READ

FS woman waits 4 years for medical negligence pay out after ‘out of court settlement’

Prolonged power outage leaves hospitals in the dark for two days

There’s more to self-care than scented candles or massages, it’s a key public health tool

Access to clean water and stable electricity could go a long way to addressing rising food poisoning in SA

EDITOR'S PICKS

Related